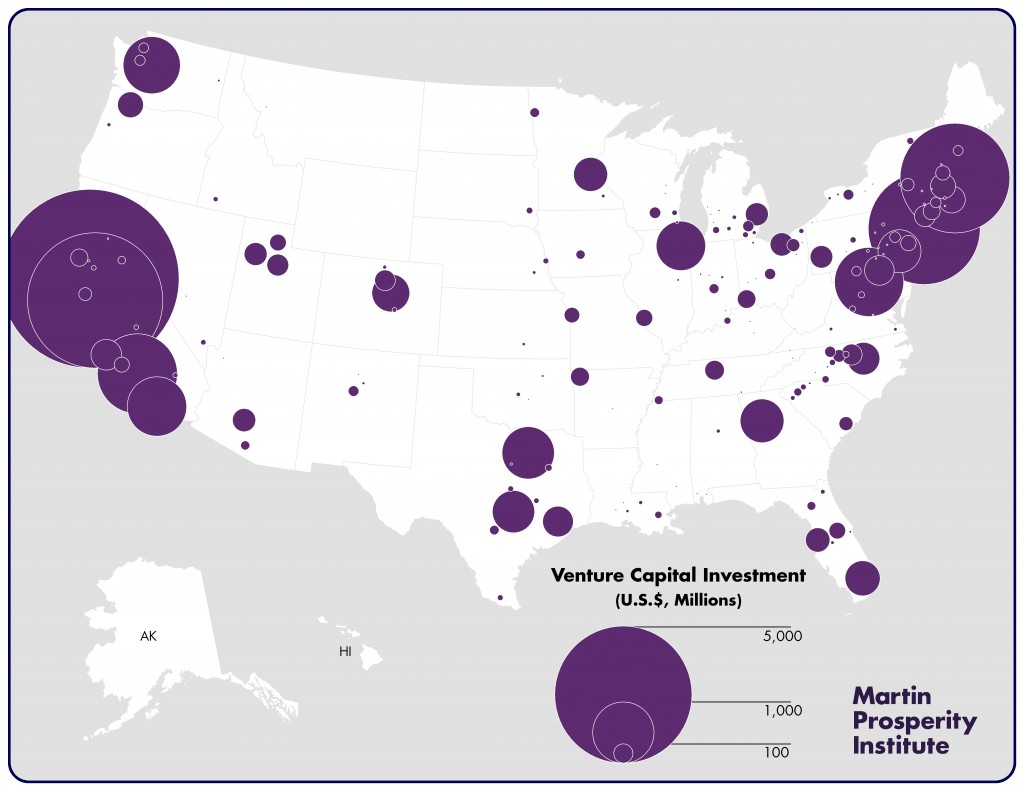

Venture capital investment helps to fuel innovation, entrepreneurship and economic growth. But its geography remains extremely concentrated and spiky in just a few key regions across the United States.

A new Martin Prosperity Institute study on Spiky Venture Capital: The Geography of Venture Capital Investment by Metro and Zip Code by Richard Florida and Karen King uses detailed data from Thomson Reuters to identify and map the leading centers for venture capital activity across the United States.

The top 50 metros account for more than 97 percent of all venture capital investment; the top 20 account for nearly 90 percent and just the top 10 account more than three-quarters of all venture capital investment nationwide.

The San Francisco Bay Area is the leading center for venture capital with $13.5 billion in investment, more than a third of all venture capital investment in the United States. However, greater San Francisco tops Silicon Valley (San Jose) with $8.5 billion in investment, a quarter of the national total compared to San Jose’s $4.9 billion, roughly 15 percent. Greater New York ranks third with $3.3 billion, roughly 10 percent. Boston is fourth with $3.1 billion (9.5 percent) and Los Angeles fifth with $1.7 billion (5.1 percent).

Venture capital investment is concentrated in three broad regional clusters across the United States. The San Francisco Bay Area, which spans San Francisco, San Jose, and several smaller metros, accounts for over 40 percent. The Boston-New York-Washington Corridor accounts for more than a quarter. Spanning Los Angeles, San Diego, Santa Barbara, and Oxnard, the cluster in Southern California accounts for another 9 percent. Together, these three clusters comprise roughly three-quarters of U.S. venture capital investment.

A similar spiky and uneven pattern of venture capital investment is evident at the zip code level. The top 50 zip codes account for nearly half all venture capital investment; the top 20 nearly a third and the top 10 roughly a fifth of all nationwide venture capital investment.

Venture capital investment predictably flows to metros with more high-tech industry, science and tech workers, and higher rates of innovation. But it is also associated with large, dense, and affluent metros that are open, diverse, and boast greater concentrations of talent.

The geography of venture capital investment in America is spiky and concentrated, mirroring the geographically uneven nature of the country’s knowledge-based, innovation-driven, and talent-oriented economy.

Download this Insight (PDF)