Venture capital financing fuels breakthrough innovations and entrepreneurial startup companies. From Intel and Apple to Google and Twitter, venture capital-backed companies give rise to the great gales of creative destruction that create entire new industries and redefine existing ones.

This report uses detailed data from Thomson Reuters to examine geographic clusters of venture capital investment and startup activity across five leading industries: software, biotechnology, media and entertainment, medical devices and equipment, and information technology services. It identifies the leading metros for venture capital investment as well as the leading neighborhoods or zip codes where such investment is clustered.

Its main findings are as follows:

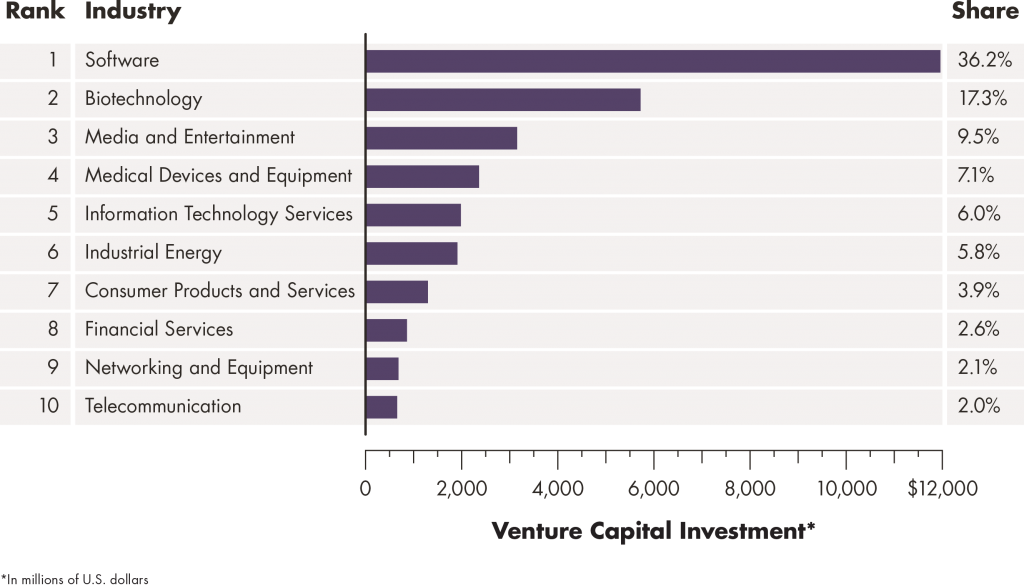

Venture capital is highly concentrated by industry. The top five industries receive $25 billion in venture capital investment, more than three-quarters of all venture investment.

- Software is the leading industry, attracting nearly $12 billion, roughly a third of all venture investment (36.2 percent).

- Biotechnology is second with $5.7 billion, 17.3 percent of total investment.

- Media and entertainment is third with $3.2 billion, 9.5 percent.

- Medical devices and equipment is fourth with $2.3 billion, 7 percent.

- Information technology services is fifth with $2 billion, 6 percent.

- Venture capital investment by industry is also concentrated in a relatively small number of geographic clusters.

Software: San Francisco tops the list with $3.3 billion, more than a quarter of all venture investment in the software industry. San Jose is second with $2.4 billion, 20 percent of the sector’s total. Together these two Bay Area metros account for $5.7 billion, nearly half of all venture investment in software. New York is third ($978 million, 8.2 percent) and Boston fourth ($907 million, 7.6 percent). Together, the metros that comprise the Boston-New York-Washington, D.C. Corridor account for $2.7 billion dollars, 23 percent of venture capital investment in software.

Software investment is also clustered and concentrated at the neighbourhood or zip code level. The leading zip code, in Palo Alto (94301), attracts $750 million, more than 6 percent of venture investment in software. Other leading neighborhoods are in and around downtown San Francisco: Rincon Hill ($652 million), Potrero Hill/Dogpatch/South Beach ($444 million), and South of Market/Mission Hill ($389 million). The top 10 zip codes account for $3.6 billion in investment, 30 percent of all venture capital investment in the sector.

Biotechnology: San Francisco also tops the list for biotechnology investment with $1.8 billion (30.8 percent), followed by Boston ($1.0 billion, 18.1 percent), San Diego ($477 million, 8.3 percent), New York ($407 million, 7.1 percent), and Washington, D.C. ($310 million, 5.4 percent).

Biotechnology investment is clustered in three broad regions. The Boston-New York-Washington, D.C. Corridor has a combined $2.3 billion in investment, roughly 40 percent of the sector’s total. The San Francisco Bay Area (which includes San Francisco and San Jose) accounts for an additional $1.9 billion, 32.4 percent of investment. Southern California accounts for $563 million, roughly 10 percent of investment in this sector.

Investment in biotechnology is also concentrated by neighbourhood or zip code. The leading neighborhoods are in San Francisco, San Diego, Boston-Cambridge, Washington, D.C., and Seattle. The top 10 zip codes alone account for 36.9 percent of all biotechnology investment.

Media and Entertainment: San Francisco again tops the list with $1.1 billion in investment (36 percent), followed by New York ($556 million, 17.6 percent), San Jose ($294 million, 9.3 percent), and Los Angeles ($294 million, 9.3 percent). The Bay Area is the biggest center with $1.4 billion, 45 percent of the industry total. A second cluster spans the Boston-New York-Washington, D.C. Corridor with $764 million, roughly a quarter of all venture investment in this sector.

Investment in media and entertainment is heavily concentrated by neighbourhood as well. A single zip code in San Francisco (94103, South of Market/Mission Hill) alone accounts for $481 million, 15.3 percent of total investment. Other neighbourhoods with a large amount of investment include Rincon Hill (94105) in San Francisco ($154 million, 4.9 percent) and SoHo/NYU (10012) in New York ($130 million, 4.1 percent). Five of the top ten zip codes are located in the Bay Area, three in New York, and one each in Los Angeles and Santa Barbara. The top ten neighborhoods or zip codes account for more than 45 percent of total investment in media and entertainment.

Medical Devices and Equipment: Boston is the leading center for venture investment in the medical devices and equipment industry with $370 million, 15.8 percent of the sector’s total. San Francisco follows close behind with $366 million (15.6 percent). Venture capital investment in medical equipment spans three main clusters. The San Francisco Bay Area (San Francisco and San Jose) accounts for $634 million, 27 percent of the national total. The Boston-New York-Washington, D.C. Corridor has a total of $550 million in investment, nearly a quarter of the industry total. Southern California

accounts for an additional $375 million, 16 percent of all venture investment in medical devices and equipment.

Venture capital investment in medical devices is also clustered by neighbourhood. The leading zip codes are found in the Bay Area, the North Carolina Research Triangle, Boston, and Southern California. Overall, three of the top 10 are located in the Bay Area, two in North Carolina, two in greater Boston, and three in Southern California. The top 10 zip codes account for roughly 30 percent of venture investment in medical devices and equipment.

Information Technology Services: San Francisco once again tops the list, and this time by a large margin, with $666 million in investment, a third of the sector’s total. San Jose is second ($283 million, 14.2 percent) followed by New York ($246 million, 12.4 percent), Boston ($156 million, 7.9 percent), and Seattle ($95 million, 4.8 percent).

Venture investment in information technology and services is again concentrated in two broad clusters: the San Francisco Bay Area, which accounts for nearly half ($949 million, 47.7 percent) of all investment and the Boston-New York-Washington, D.C. Corridor, which makes up another quarter ($604 million, 30.4 percent) of total investment.

Investment in information technology services is again clustered by neighborhood. Seven of the top 10 zip codes in the sector are located in the Bay Area with five in San Francisco proper, and one each in New York, Baltimore, and Atlanta. The top ten neighborhoods account for 37 percent of venture investment in information technology and services.

San Francisco dominates venture capital investment across these five leading industries, topping the list in four out of five sectors — software, biotechnology, media and entertainment, and information technology services — while placing second in medical devices and equipment. San Jose falls in the top three in four industries: software, media and entertainment, medical devices and equipment, and information technology services. New York falls in the top three in software, media and entertainment, and information technology services. Boston is first in investment in medical devices and equipment and second in biotechnology.

Venture capital investment is also concentrated and clustered at the neighbourhood level,

with several zip codes placing highly across industries. These leading zip codes are mainly clustered in and around downtown San Francisco, including 94105 (Rincon Hill) and 94107 (Potrero Hill/Dogpatch/South Beach), 94103 (South of Market/Mission District), and 94104 (Financial District). Other leading zip codes include 94063 in Redwood City and 94301 (Palo Alto), both in the Bay Area, and 92121 (Sorrento Valley, San Diego) near the University of California, San Diego.

Venture capital investment by industry is spiky, clustered, and concentrated in a relatively small number of metros and zip codes in the Bay Area and the Boston-New York-Washington, D.C. corridor.

Download this Report (PDF)