Venture capital has long been the kind of finance that powers new and innovative startup companies. For most of its modern history, venture capital investment has flowed to startups located in suburban office parks. Using new and more detailed data at the zip code-level, our research finds a considerable shift in venture capital investment and startup activity toward urban areas.

Previous research on venture capital investment and startup activity has been hampered by a lack of data at the neighborhood level. Our research uses more granular data from Thomson Reuters to identify venture capital investments that flow to urban versus suburban neighborhoods based on zip codes. We further explore the location of venture capital investment and startup activity by the way people commute to work — looking at the share of workers who walk, bike, or use transit versus those who drive their own cars to work.

We examine venture capital investment at the neighborhood level across the entire United States and in the three city-regions or metro areas that receive the largest amounts of venture capital: The San Francisco Bay Area, New York, and Boston-Cambridge which together account for nearly $20 billion in venture capital investment or 60 percent of all venture capital investment in the United States.

Our main findings are as follows.

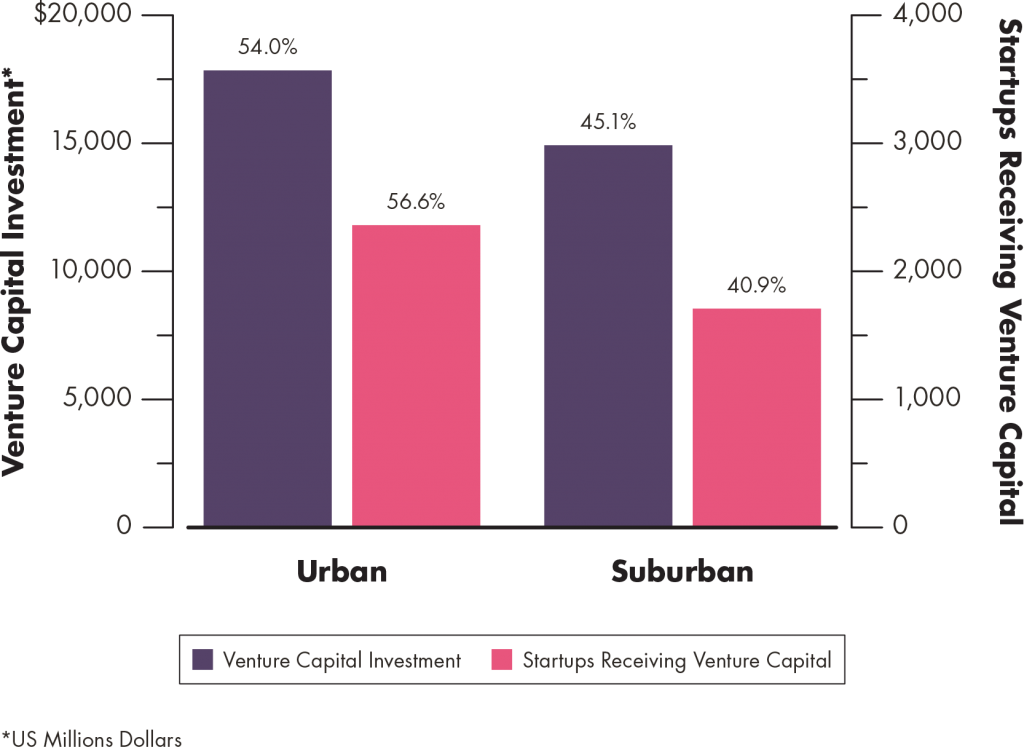

- The majority of venture capital investment and venture capital backed startup activity takes place in urban areas with urban zip codes accounting for 54 percent of venture capital investment versus 45 percent going to suburban zip codes.

- In New York, more than 80 percent of venture investment flows to urban zip codes; in the Bay Area roughly 60 percent of all venture investment flows to urban neighborhoods; and in Greater Boston 54 percent of investment is located in urban areas.

- In neighborhoods that receive venture capital investment, nearly twice as large a share of workers walk, bike, or use transit to get to work compared to the national average (16.6 percent in venture capital neighborhoods versus 8.4 percent overall).

- More than a quarter of venture capital investment is concentrated in neighborhoods where more than half of all workers walk, bike, or use transit, and more than a third is located in neighborhoods where more than 30 percent do so.

- Nearly 38 percent of all venture capital investment in the San Francisco Bay Area, New York, and Boston is located in neighborhoods where more than half of all workers walk, bike, or use transit to get to work.

- There are two neighborhoods in the United States that receive more than a billion dollars each in venture capital. In these neighborhoods — both located in downtown San Francisco — roughly 60 percent of workers walk, bike, or use transit to get to work.

Download this Report (PDF)

Listen to Richard Florida talks Venture Capital Investment on SoundCloud