Entrepreneurial startup companies are the drivers of innovation in the new knowledge economy. Fueling their rise is investment from venture capital firms. Nearly two billion dollars in venture capital was invested in Canada in 2013. Across the world, Canada ranks fifth in global venture capital, behind the United States, China, India, and the United Kingdom, with less than five percent (4.7 percent) of total global venture capital activity.

Startup City: Canada, a new Martin Prosperity Institute study by Richard Florida and Karen King, examines venture capital activity in Canada, identifying its leading cities and metros and mapping its urban orientation in the county’s three largest venture capital hubs: Toronto, Vancouver, and Montréal.

The study finds that venture capital investment is highly clustered and concentrated. Taken together, Canada’s five largest metros — Montréal, Vancouver, Toronto, Ottawa-Gatineau, and Calgary — account for 87 percent its total venture capital investment.

Montréal leads with $633 million, roughly a third (32 percent) of all Canadian venture capital investment. Vancouver is second with $380 million, roughly 20 percent (19 percent) and Toronto is third with $358 million (18 percent). Ottawa-Gatineau is fourth with $202 million, Calgary fifth with $129 million, and Kitchener-Waterloo sixth with $57 million.

This interactive map shows historical trends in the geography of Canada’s venture capital industry from 2000 to today.

Click here for the full-size interactive map.

The study also examines the location of venture capital investment in cities versus suburbs across Canada’s three largest metros — Toronto, Vancouver, and Montréal.

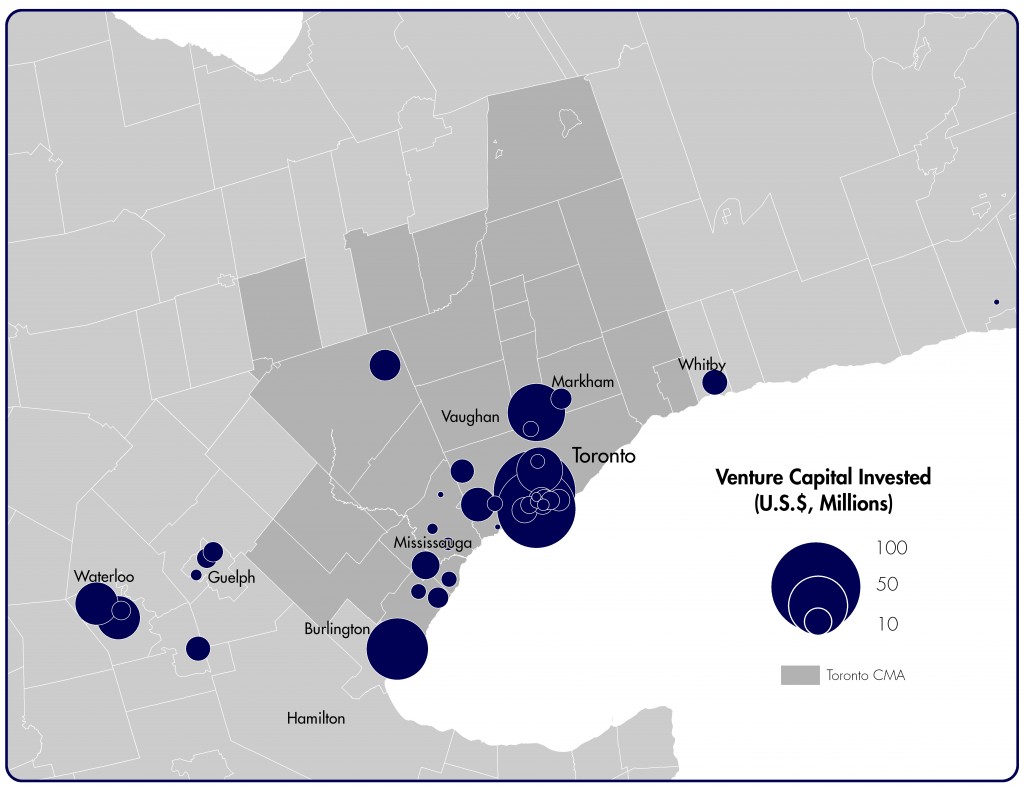

The map above shows the major clusters of venture capital investment across Greater Toronto. The largest dots, indicating the largest volumes of venture capital investment, are in and around the city center. These investments straddle the business and financial core, with large concentrations around the University of Toronto. There are also clusters of investments outside the urban center and the city in and around Markham, Mississauga near Toronto Pearson International airport, Burlington, Guelph and Kitchener-Waterloo.

Roughly three-quarters (75.6 percent) of venture capital investment in Toronto went to areas in and around the urban core. In Montréal, an even greater share of venture capital investment (82.9 percent) flows into on the urban center. And in Vancouver, roughly 70 percent (70.3 percent) of venture capital investment went to areas in and around the urban core. Across these three metros, urban areas accounted for 77.3 percent of venture investment compared to just 22.7 percent for suburbs. The majority of these investments were located close to the urban center and/or around major research hubs like the University of Toronto, the University of British Columbia, and McGill University.

Despite Canada’s relatively high rank among global venture capital hubs, it continues to underperform on venture capital investment. The nation’s total represents less than 6 percent of the $35 billion invested in the United States, and less than a third of the $7 billion dollars invested in the San Francisco Bay Area.

Download this Insight (PDF)