Greater Miami has dramatically improved its ability to attract venture capital in 2013 over previous years, raking in more $300 million, ranking 16th among all U.S. metro regions.

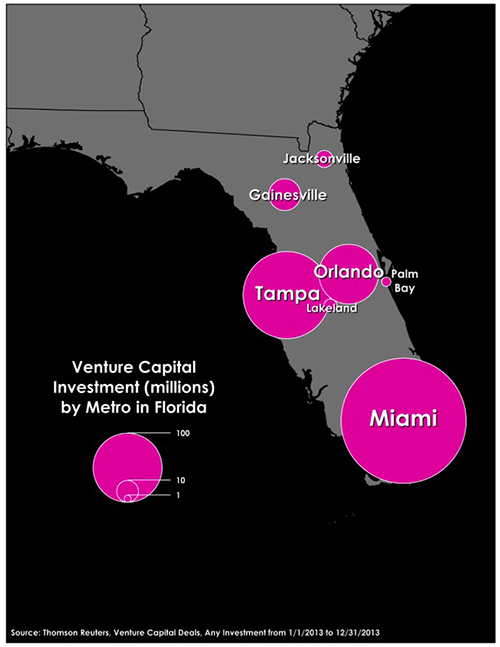

The broader Southern Florida (So-Flo) mega-region that includes not just Miami and its environs but Tampa (with $150 million plus in venture investment) and Orlando ($75 million in venture investment) took in nearly $600 million, which would place it among the top dozen venture capital regions in the country, roughly comparable to Greater Chicago. The So-Flo mega-region is home to 15 million people and produces more than $750 billion in economic output, roughly the same as the Netherlands, placing it among the twenty largest national economies in the world.

The map below, based on an analysis of the latest Thompson Reuters data by Richard Florida and his team at the Martin Prosperity Institute at the Rotman School of Management at the University of Toronto, charts venture capital investment in greater Miami and all of Southern Florida in 2013. This surge in venture capital investment represents both a sea change and a tremendous opportunity for Miami and the South Florida region.

Exhibit 1: Venture capital investment (millions) by metro in Florida

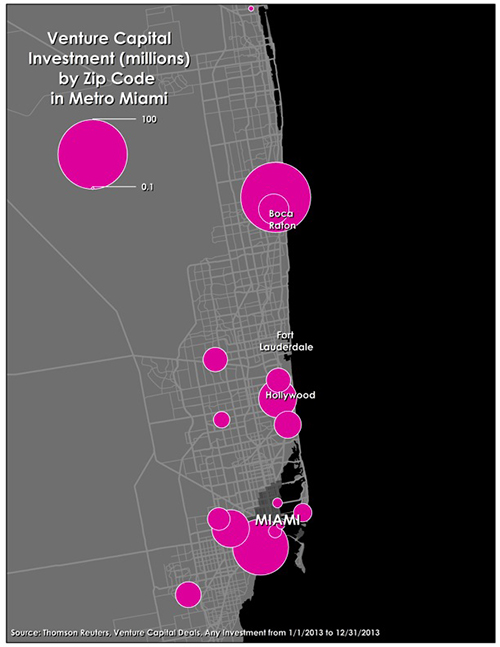

The second map (below) shows the location of venture capital investment across Greater Miami by zip code, allowing us to zero in more precisely on the attributes of the locations where venture investment and startup activity are clustering.

Exhibit 2: Venture capital investment (millions) by zip code in Metro Miami

Across the metro area, Boca Raton accounts for the largest share of venture capital, more than $120 million across two zip codes ($93 million went to a single company, OpenPeak, an enterprise software developer). Coconut Grove accounted for $65 million, Hollywood’s take was $30 million, and Miami Airport’s (again across two zip codes) was almost $30 million.

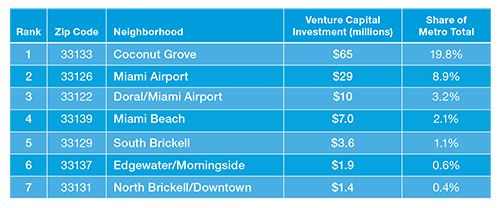

Exhibit 3: Leading neighbourhoods for venture capital investment in the Greater Miami Metro

Venture capital and startup activity across the United States has been in the midst of a back-to-the-city shift. For decades, venture capital and startup activity was mainly located in suburban office complexes, like Silicon Valley California, the Route 128 technology corridor in suburban Boston, and suburban Seattle where Microsoft is located. But over the past several years, as cities and urban centers have become more attractive places to live and work, venture capital and startup activity has started to come back to the city as well. According to a major report released today by Richard Florida and his MPI research team, urban areas in San Francisco now attract more venture capital than Silicon Valley and Lower Manhattan has emerged as a significant start-up center. Techies and entrepreneurs are increasingly choosing to live in denser, livelier, more diverse locations. By locating in urban neighborhoods startups can be closer to talent and also leverage existing amenities and services, from restaurants to health clubs and day care, instead of providing those services themselves. Older industrial and warehouse buildings provide the open plan layouts these companies and their workforces desire, where employees can walk, bike or use transit to get to work.

The table below shows the leading neighborhoods for venture capital investment and startup activity in Miami-Dade County. While there is a major cluster of activity out near the Miami Airport, the majority of neighborhoods are either in walkable suburbs such as Coconut Grove (33133) and Miami Beach (33139), or in close proximity to downtown, such as North Brickell Downtown (33131), South Brickell (33129), and Edgewater-Morningside (33137).

Exhibit 4: Leading neighborhoods for venture capital investment in Miami-Dade County

Miami is well positioned to take advantage of the urban shift in venture capital and startup activity. It has the old industrial spaces and art districts like Wynwood that have been home to the arts and creative community and where incubator spaces such as Lab Miami are located, as well as the first U.S. branch of the global entrepreneurial assistance initiative Endeavor.

In cities like San Francisco and New York, the urban tech explosion has occurred in a dramatic way that has created tremendous pressure on real estate, radically changing the character of old neighborhoods and sparking significant backlash.

Miami has the opportunity to learn from this. It has the space required for urban neighborhoods to absorb entrepreneurial startups without being overrun by them. And it has the chance to

develop a long-run plan for making urban startups part of a broad strategy for more

inclusive growth.

Download this Insight (PDF)